Berra, Buffett and the S&P 500

It’s tough to make predictions, especially about the future. (1) - Yogi Berra

We make investment decisions based on our evaluation of the most profitable combination of probabilities. (2) - Warren Buffett

Fashion changes. In the last 120 years, the au courant look in men’s facial hair has gone from handlebars to clean shaven to Fu Manchus and now to the de rigueur three-day stubble of today’s manly man. In the 1950’s, men and women loved to drape themselves in fashionable attire, but by the hippie era of the late ‘60’s, fashion itself had gone out of fashion. In my lifetime I have seen women aspire to all sorts of shapes, from the Rubenesque curves of Marilyn Monroe to Twiggy’s bony boyishness to the steatopygiac buttocks of the Kardashians. But one thing that has never gone out of fashion is the consistent human longing to see into the future. It’s a fool’s game, as the immortal Yogi so idiosyncratically pointed out, but that hasn’t stopped soothsayers from using everything from goat’s entrails to algorithms to try to get tomorrow’s news today.

We don’t attempt to foretell returns in the stock market, but like Warren Buffett, prefer to focus on probabilities. And for investors today, we believe the trillion dollar question that they should be asking themselves is “what is the probability that the S&P 500 over the next five years will earn a return that they consider satisfactory?” Our answer to the question: pretty low.

We calculate potential returns in various sectors of the stock market by combining factors: earning’s growth, dividend yield, and current and average price/earnings ratios. Over the last 50 years, earnings for the S&P have grown around 6% annually, the current dividend yield is 1.3%, the current P/E ratio is 20.7 and the average P/E ratio over the last 20 years has been 15.7. (3) We assume that earnings and dividends will grow at this historic rate over the next 5 years, and that at some point in time during this period the P/E ratio will revert to its historical average. Here is what the returns will look like if the P/E ratio drops to its historical average at the end of each period:

These are total returns, not annualized ones, which means that in the best case – the P/E does not decline to 15.7 until 5 years from now -- the annual return would be less than 1% per year. Of course, the market is not going to behave exactly like this, falling to a precise 15.7 P/E at these exact moments, but this approach gives a good, ballpark idea of the probability of the S&P earning satisfactory returns going forward.

Both the current P/E and the historical average numbers come from JP Morgan’s Guide to the Markets. The figures from other services may look different, depending on how they calculate earnings -- whether they include one-time write-offs, whether the numbers are forward or backward looking, etc. (JP Morgan’s are forward looking). For example, many analysts have current trailing S&P earnings at around $190, (4) which means the P/E ratio now stands at 27X. It also means that the average P/E over the last 20 years is higher than 15.7. But using these higher numbers in my calculations leads to a very similar result: the outlook for gains in the S&P 500 over the next five years is not promising.

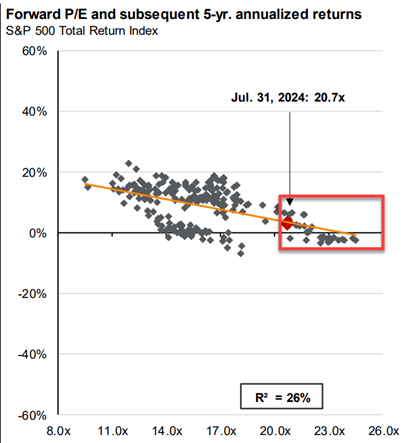

If history doesn’t repeat itself, but often rhymes, as Mark Twain said, how has the S&P performed in the past after its P/E ratio had reached these levels? The picture is only marginally better, as you can see from this chart. (5)

Over the last 20 years, when the P/E ratio has been in the 20-27 range, the bulk of the subsequent annual 5-year returns have been negative, with only a few periods rising to mid-single digits.

Whether you look forward or backward, the S&P 500 is not screaming “Buy Me!”

Next Blog Post – Investors who are worried about the outlook for the S&P may be asking themselves a logical question: are there any areas of the investment markets which look promising using the same type of analysis we’ve used above? We will have the answers in our next post!

Don Harrison

(1) https://www.goodreads.com/quotes/261863-it-s-tough-to-make-predictions-especially-about-the-future

(2) https://www.azquotes.com/author/2136-Warren_Buffett/tag/probability

(3) https://www.in2013dollars.com/us-economy/s-p-500-earnings. https://www.gurufocus.com/economic_indicators/150/sp-500-dividend-yield, https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

(4) https://www.gurufocus.com/economic_indicators/58/sp-500-earnings-per-share

Any opinions are those of Don Harrison and not necessarily those of Raymond James Financial Services, Inc., or of Raymond James. The information contained in this presentation does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.